However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock's price movement. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts. They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. While Wall Street analysts have deep knowledge of a company's fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets.

In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading. Here's What You Should Know About Analysts' Price TargetsĪccording to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. While a positive trend in earnings estimate revisions doesn't gauge how much a stock could gain, it has proven to be powerful in predicting an upside. Strong agreement among analysts about the company's ability to report better earnings than they predicted earlier strengthens this view.

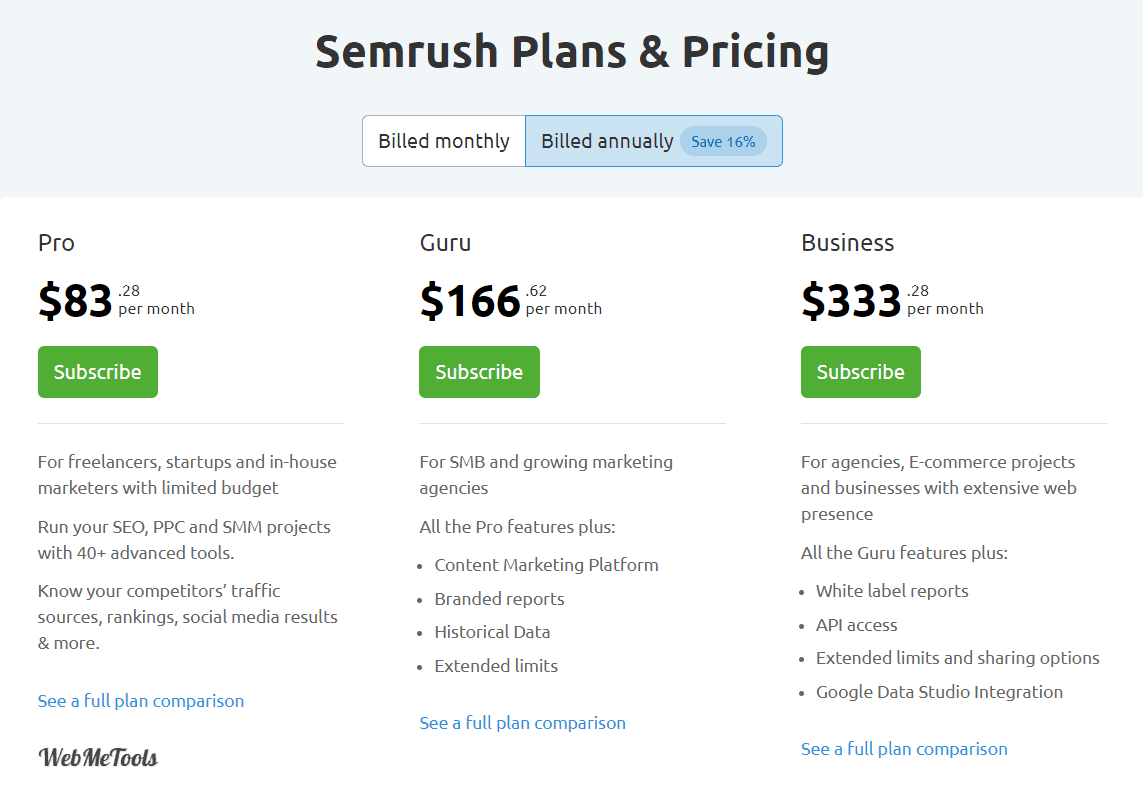

That's because the ability and unbiasedness of analysts in setting price targets have long been questionable.īut, for SEMR, an impressive average price target is not the only indicator of a potential upside. While the consensus price target is a much-coveted metric for investors, solely banking on this metric to make an investment decision may not be wise at all.

0 kommentar(er)

0 kommentar(er)